Download the Sector Selects Research Report here.

Exchange Traded Funds (ETFs) are a type of fund that owns underlying assets like stocks, bonds, or futures, and divides that ownership into assets. ETFs, as the name implies, are traded on an exchange. They can easily be bought, sold, and transferred while the market is open.

These funds can track underlying sectors as well. Currently, there are 11 sector ETFs.

- Energy (XLE)

- Utilities (XLU)

- Technology (XLK)

- Materials (XLB)

- Consumer Staples (XLP)

- Consumer Discretionary (XLY)

- Industrials (XLI)

- Communication (XLC)

- Health Care (XLV)

- Financials (XLF)

- Real Estate (XLRE)

Through analysis of sector performance, TradeSmith has developed a method to help investors choose which sector might perform best. Our research has found that investing in the sectors when 70% of all sector ETFs are in the SSI Green or Yellow Zone is best.

As a reminder, the Stock State Indicator (SSI) shows the health of a stock or fund. The Yellow Zone tells us that an investment is correcting. The Green Zone tells us that the investment is healthy.

So, if seven or more sector ETFs are in the green or yellow zone, an investor could look to invest in the best positions from those green and yellow sectors. This is the basis for our Sector Selects strategy in Ideas by TradeSmith. It filters for the top performing stocks from the green and yellow zones and adds our proprietary filter to weed out stocks with a high average volatility and low trading volume. In addition, it looks for stocks that are trading at a profit.

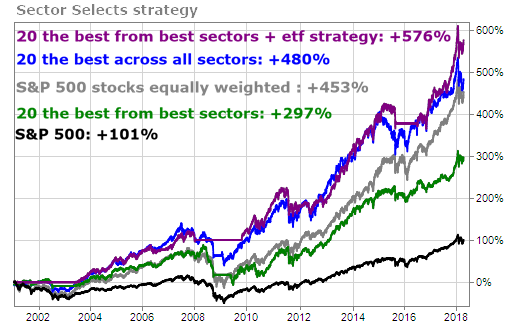

Below, you can see the performance of this technique.

When we combine the top 20 positions with the Sector Selects strategy, we were able to outperform the S&P 500 over the same time. If you look closely at the purple line on the chart above, you can see that the strategy had you out of the market (in cash) during the early 2000s and during the 2008 market downturn.

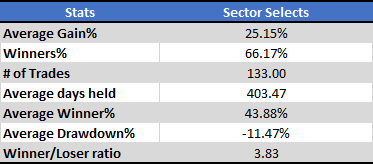

Below, you’ll find the statistics for the Sector Select performance.

The Sector Selects saw an average gain of 25.15% in less than two years with an average drawdown of just 11.47%. That’s a nice performance in such a short time.

How Does One Follow the Sector Selects Strategy?

- Invest only if seven or more sector ETFs are in the Green or Yellow Zone. If more than 30% of sector ETFs are in the red zone, go to cash as other sectors get stopped out.

- Choose the top 20 positions from the sectors in the Green or Yellow Zone.

When making picks, it is best to take other factors into consideration – like if a position meets any of our other investment methods.

Take Conoco Phillips (COP), for example. This stock belongs to the Energy sector, which triggered an SSI Entry Signal in March 2019. The stock matched four of our strategies.

- Within our ranking system, it was listed at the top with the most recent Entry Signal.

- COP also met the Kinetic VQ requirements.

- It became a Low Risk Runner in fall 2017.

- It was also held by some billionaires, including Arnold Van Den Berg and Barrow-Hanley

By meeting multiple strategies and being held by multiple billionaire investors, this gives Conoco Phillips extra conviction. The stock has more potential to perform well. We’d exit the trade once COP hits the SSI Red Zone.

What Happens When a Sector is Stopped Out?

What if you’re holding a position in the Materials sector and Materials turns red, but the position you’re holding is still green or yellow?

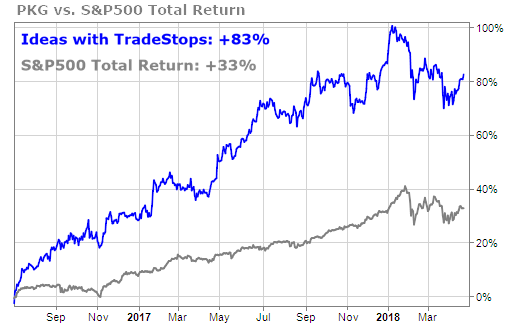

Here’s an example: Packaging Corporation of America (PKG) belongs to the Materials Sector (XLB), which was stopped out as of this writing. Despite the sector being stopped out, it is quite possible for the stock to continue to perform well.

As we can see in the chart above, PKG has greatly outperformed the S&P 500. We would only exit PKG once it hits its stop-loss price, despite the status of the sector as a whole.

From there, we’d either replace PKG with a pick from another sector (if 70% of sectors are in the Green or Yellow Zone) or we’d go to cash (if more than 30% of sectors are in the Red Zone).

Benjamin Franklin said, “An investment in knowledge pays the best interest.” Here at TradeSmith, we’re committed to making you a more educated investor. The Sector Selects strategy can help educate you on which sectors are performing best and when might be the best time to enter, or even exit, the markets. A little bit of knowledge on the sector performance can help pay your portfolios some interest in the way of profits.